This is the time to arrange lifelong health coverage.

Regardless of how young or old you feel at 64, you should make sure to sign up for Medicare.

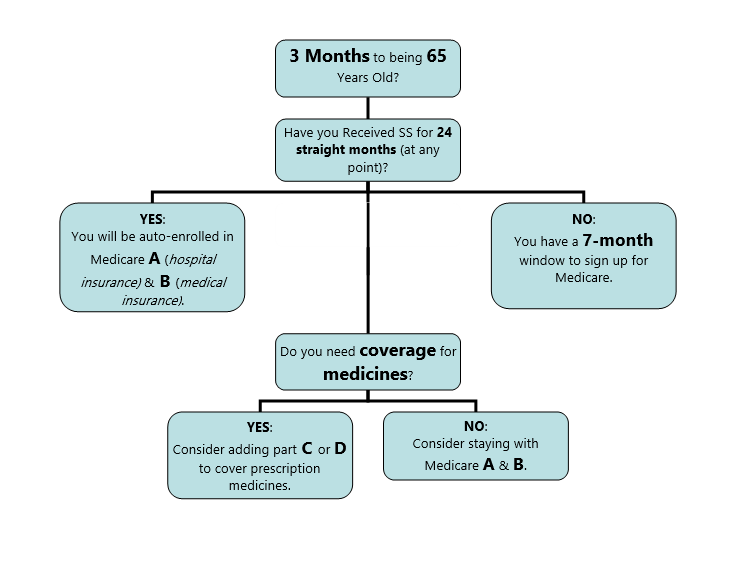

The sign-up period will be here before you know it. Medicare gives you a 7-month window in which to enroll. That initial enrollment window opens three months prior to the month in which you turn 65 and closes three months after the month in which you turn 65.1

If you fail to enroll within that 7-month period, the chances are good that you will end up paying a late-enrollment penalty for not signing up for Part B coverage on time. You will also have to wait until the next general enrollment period (January 1-March 31) to sign up.1,2

Are you already receiving Social Security retirement benefits? Have you received them for 24 straight months at any point? If your answer to either of those two questions is “yes,” then you will be enrolled in Medicare Part A and B, automatically. You will get your Medicare card in the mail about three months prior to turning 65.2

Are you currently covered under an employer or former employer’s health plan? If so, you might qualify for a special enrollment period.

If you are approaching your 65th birthday, your employer (or your health plan administrator) may require you to enroll in Medicare at the first opportunity. Not all companies demand this. If yours does not, then you can sign up for Medicare coverage later, without being hit with late-enrollment penalties.2

If you are still working at 65 and have employer-sponsored health coverage, you face no requirement to sign up for Medicare until you retire or that coverage disappears.

The month after your employment ends or your employee health benefits linked to that employment end (whichever comes first), an 8-month enrollment period will open for you to enroll in Medicare.2

Common misconceptions of coverages debunked:

- COBRA does not meet Medicare’s definition of employer-sponsored health insurance

- A health plan sponsored by one of your past employers does not meet Medicare’s definition of employer-sponsored health insurance

- You will be allowed no special enrollment period under the above mentioned coverage circumstances.2

You will need to decide what types of coverage you prefer. Parts A and B are the basic parts of Medicare. (Sometimes they are simply referred to as “Original Medicare.”) Part A is hospital insurance, and Part B is medical insurance.

Most people pay nothing for Part A; effectively, they have prepaid for the coverage by paying Medicare taxes during years on the job. Every Medicare recipient pays a monthly Part B premium. At this writing, the Part B premium for most Medicare recipients is $134. Should you still be working, this may be all the coverage you need if your employer offers health benefits.1

You may want more coverage than Parts A and B provide. You might be interested in a Medicare Supplement Insurance (Medigap) policy or a Part D plan to help you pay for medicines. Or, you could sign up for a Part C (Medicare Advantage) plan, offering all basic Medicare benefits, plus prescription drug and medical coverage.3

Contact a Medicare specialist before you enroll!

Medicare remains intricate; its nuances, hard to grasp.

A financial or insurance professional well versed in Medicare enrollment, benefits, and regulations can make the process simpler for you. Make sure you consult your financial professional before finalizing a retirement plan.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

Citations.

1 – medicare.gov/people-like-me/new-to-medicare/getting-started-with-medicare.html [11/20/17]

2 – fool.com/retirement/general/2016/05/14/do-i-get-medicare-when-i-turn-65.aspx [5/14/17]

3 – kiplinger.com/slideshow/retirement/T039-S001-10-things-you-must-know-about-medicare/index.html [5/17]